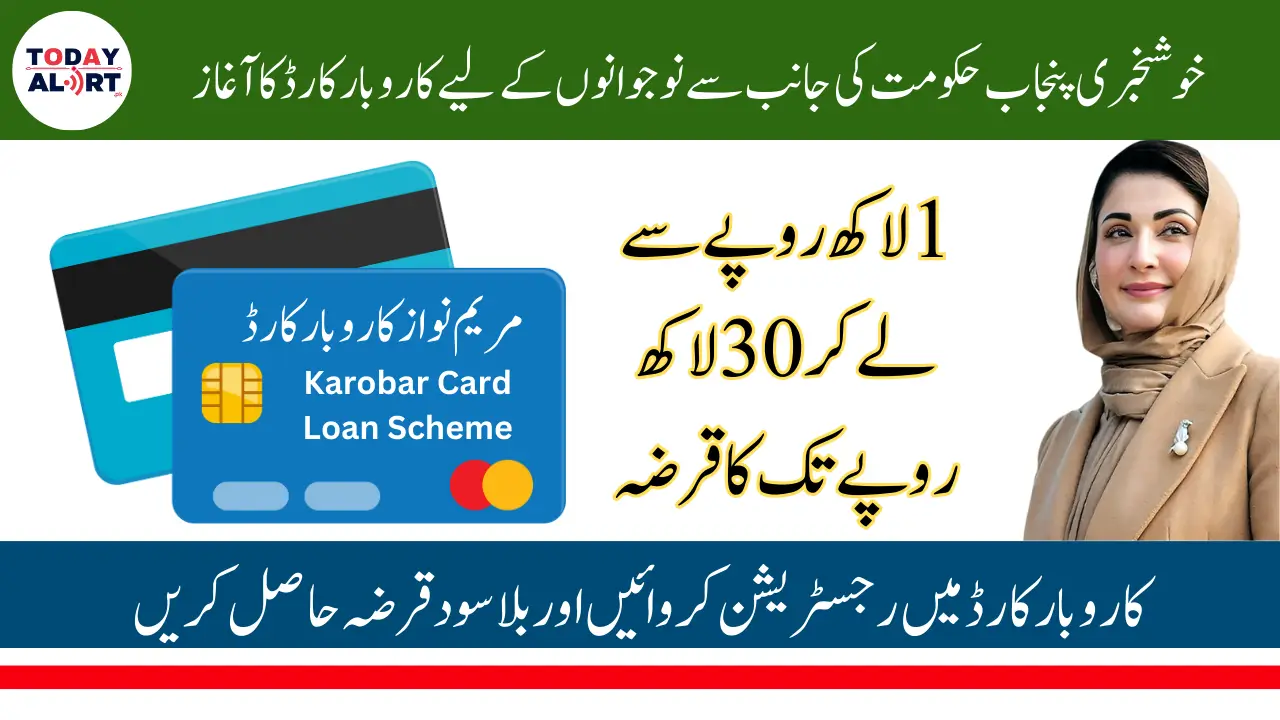

Maryam Nawaz Karobar Card Loan Scheme

Maryam Nawaz Karobar Card Loan Scheme is a revolutionary initiative of the Punjab government, which aims to make the youth independent and eliminate unemployment. Under this scheme, interest-free loans ranging from Rs 100,000 to Rs 30,0000 will be provided to the youth so that they can start or expand their small or medium-sized businesses. A five-year easy installment scheme has been set up for the repayment of the loan so that the youth do not face financial pressure.

This scheme will not only provide employment opportunities to the youth but will also strengthen the economy of Punjab. The registration process will start in January 2025, and applicants will have to submit their applications with their identity documents. The loan distribution process will be transparent and the selected candidates will be determined through a draw.

This revolutionary scheme will not only make the youth of Punjab independent but will also play an important role in the development of the economy. If you dream of starting a business, then this is a golden opportunity for you. Keep an eye on the official website for more information.

Benazir Taleemi Wazaif New Payment Dates Announce – How Check and Get Stipend

Features of the Karobar Card Loan Scheme

- Loan Amount Ranges:

- Small businesses: Loans ranging from Rs. 1 Lakh to Rs. 10 Lakh.

- Medium-sized businesses: Loans up to Rs. 30 Lakh.

- Interest-Free Loans:

- No interest will be charged on the loans provided under this scheme, ensuring ease and affordability for young entrepreneurs.

- Flexible Repayment Period:

- Loans can be repaid in easy installments over 5 years, offering a stress-free experience for borrowers.

Good News! Benazir Kafaalat 13500 New Installment 2025 Now Open – Apply Today

Objectives of the Scheme

The primary goal of the Karobar Card Loan Scheme is to uplift unemployed youth by providing them with financial resources to start or grow their businesses. This initiative aims to:

- Generate employment opportunities: Encourage entrepreneurship among the youth and reduce unemployment across Punjab.

- Boost the economy: Strengthen small and medium enterprises (SMEs) to contribute to the province’s and country’s overall economic growth.

- Empower youth: Provide financial independence and skills to Punjab’s young population.

BISP Phase 3 Payment Details Resolve Issues, Check Eligibility, and Prepare for Phase 4 Payments

Kaorobar Card Registration Process and Timeline

- Registration Start Date:

The Karobar Card Loan Scheme registration will commence in January 2025. - Required Documents:

To ensure successful registration, applicants will need to submit:- CNIC (Computerized National Identity Card)

- Contact information (phone number and address)

- Name and relevant business details

- Transparent Selection Process:

- Applications will be shortlisted through a balloting system.

- Those selected in the draw will receive interest-free loans as per the scheme guidelines.

- Announcement of Registration Portal:

- The Punjab government will soon introduce a dedicated website for online registration.

- Applicants can stay updated by following announcements on official channels and websites.

Maryam Nawaz Loan Scheme 2024 Online Apply For 15 Lakh Loan

Karobar Card Loan Categories

The Karobar Card Loan Scheme offers two types of loans tailored to support businesses of different scales:

- Small Business Loans:

Loans ranging from Rs. 1 Lakh to Rs. 10 Lakh for individuals starting small-scale businesses. - Medium-Sized Business Loans:

Loans of up to Rs. 30 Lakh for those planning to establish medium-sized enterprises.

BISP 2025 Registration Started For New Beneficiaries For 13500 Payment

Benefits of the Karobar Card Scheme

This initiative provides several benefits for the youth and society as a whole:

- Interest-Free Financial Support: Encourages individuals to take risks and start businesses without financial stress.

- Job Creation: New businesses will help generate employment opportunities across Punjab.

- Economic Growth: Empowered entrepreneurs contribute to the province’s economy, enhancing prosperity for all.

- Ease of Repayment: A 5-year repayment period ensures accessibility and affordability for borrowers.

Punjab Solar Panel Scheme Registration Through Portal And SMS – Step by Step Guide

Conclusion

The Karobar Card Loan Scheme is a revolutionary initiative by the Punjab government under the leadership of Maryam Nawaz Sharif. By providing interest-free loans of up to Rs. 30 Lakh, it empowers the youth to combat unemployment and actively participate in the province’s economic growth.

Stay tuned for more updates regarding the registration process and eligibility criteria. If you’re an unemployed youth in Punjab looking to start a business, this scheme offers a golden opportunity to turn your dreams into reality.

For the latest information, visit our website regularly and follow us on social media platforms.

Frequently Asked Questions (FAQs)

1. What is the Karobar Card Loan Scheme?

It is a program initiated by the Punjab government to provide interest-free loans for unemployed youth, enabling them to start small and medium businesses.

2. What loan amounts are offered?

Loans range from Rs. 1 Lakh to Rs. 10 Lakh for small businesses and up to Rs. 30 Lakh for medium-sized businesses.

3. Is the loan interest-free?

Yes, all loans under this scheme are completely interest-free.

4. What is the repayment period?

Borrowers can repay the loans in easy installments over five years.

5. When will the registration process begin?

The registration process will start in January 2025.

6. What documents are required for registration?

Applicants need to submit their CNIC, name, address, phone number, and relevant business details.

7. How will loan recipients be selected?

Selection will be done via a balloting process conducted by the Punjab government.

How to Use the 8171 Web Portal to Check Your 13500 Payment Status