PM Youth Loan Scheme 2024

The Prime Minister of Pakistan, Shehbaz Sharif, has launched an excellent entrepreneurship program for the youth of Pakistan under the Prime Minister Youth Business and Agriculture Loan Scheme. Under this program, more than 15 commercial, Islamic, and SME banks will provide loans to the youth at very low interest rates and with easy installments.

PMYB&ALS promotes entrepreneurship among youth by providing business loans through banks on easy terms and with low markups.

- All residents of Pakistan between the ages of 21 and 45 years can be a part of the Prime Minister’s Youth Business and Agriculture Loan Scheme, a scheme launched by the Government of Pakistan. People between the ages of 21 and 45 can apply online for a new business loan under this scheme.

- The minimum age to get a loan for an IT and a commerce-related business is 18 years.

This is a very good step by the government of Pakistan for the youth, which they can take advantage of to improve their future and make Pakistan famous worldwide.

Under the Prime Minister Youth Business and Agriculture Loan Scheme, you can apply for a loan online. Visit the official website now to submit your application.

You can also apply the PM Laptop Scheme.

Loan Types:

Prime Minister of Pakistan Shahbaz Sharif has recently launched a loan scheme for youth businesses and agriculture to increase employment opportunities within Pakistan and eliminate unemployment. Under this PM loan program, all Pakistanis between the ages of 21 and 45 can get a loan of up to 75 Lac for their business at low markup rates and expand their businesses extensively.

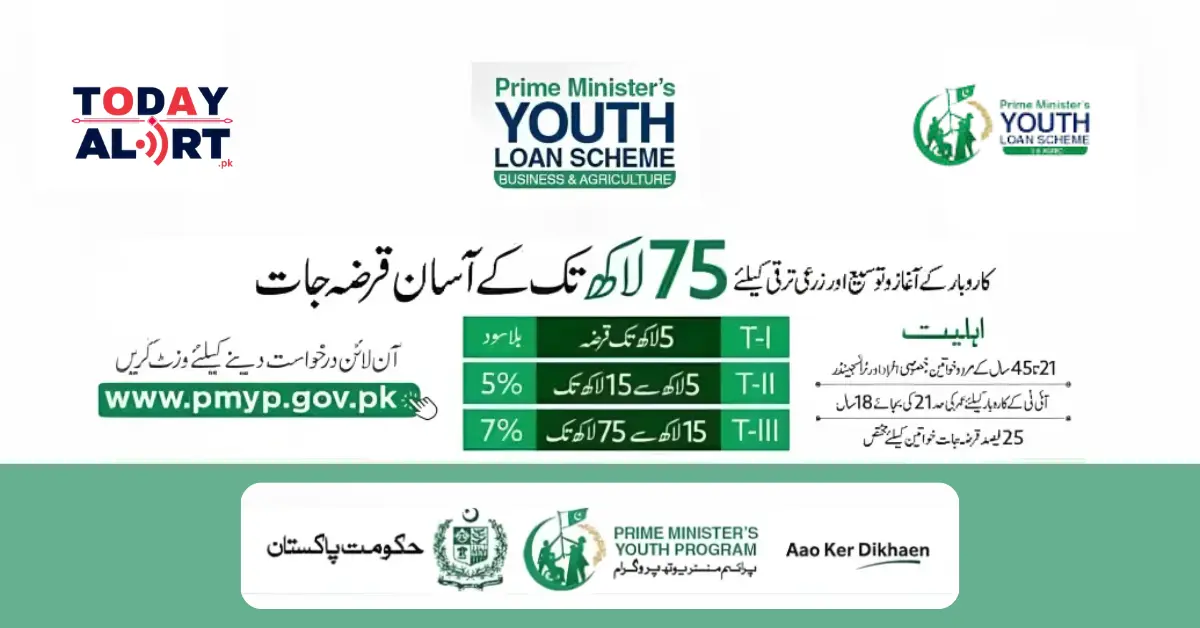

Loans under the Prime Minister’s Youth Business & Agriculture Loan Scheme will be provided in three Tiers. The markup rate on the loan amount depends on the loan amount. For this purpose, three different tiers have been created to avail of loans from the government.

Tier 1:

For those who want to get a loan of up to 5 Lac (0.5 million), the Markup rate is 0%.

Tier 2:

For those who want to get a loan from 5 Lac (0.5 million) to 15 Lac (1.5 million), the markup rate is 5%.

Tier 3:

The markup rate is 7% for people who want to get a loan from 15 Lac (1.5 million) to 75 Lac (7.5 million).

Banks List who provide PM Youth Loan:

- Bank Alfalah Islamic

- Askari Islamic Banking

- Bank of Khyber Raast Islamic Banking

- Zarai Taraqiati Bank Limited

- United Bank Limited

- Meezan Bank Limited

- MCB Bank Limited

- Habib Bank Limited

- First Woman Bank Limited

- Bank Islamic Pakistan Limited

- Bank Al Habib

- Bank Al Falah

- Askari Bank Limited

- Allied Bank Limited

- Bank of Khyber

- Bank of Punjab

- National Bank of Pakistan

Also Read: Punjab Rozgar Scheme 2024.

Purposes of youth loan scheme:

The main objective of the Prime Minister Youth & Agriculture loan program is to improve Pakistan economically because:

- Under this scheme, the trend of the young generation will increase towards business, strengthening Pakistan economically.

- Agriculture loans will improve Pakistan’s agriculture and increase agricultural production.

- Providing loans to people in the IT field will improve the future of the young generation because, With this money, they can open their e-commerce store and do business all over the world from home, increasing Pakistan’s foreign exchange.

How is Eligible for PM Youth Loan Scheme?

- Do you want to know who can be eligible for the PM Youth Loan Scheme?

- People who fulfill the following criteria can easily qualify for this scheme

- All Pakistani citizens between the ages of 21 and 45 with entrepreneurial ability are eligible to apply.

- Also, the minimum age requirement for IT and e-commerce-related firms is 18 years.

- You can easily check the complete application procedure by visiting the official website.

Benefits of the PM Loan Scheme:

Following are some major benefits of the PM loan scheme

- People’s tendency will be towards business.

- New technology will increase agriculture.

- The future of the young generation will be better.

- The economic condition of Pakistan will be strong.

- New employment opportunities will increase, and unemployment will also end.

- Poverty will be eradicated due to new businesses.

- The best thing is that the markup rate of this loan is very low, making it easy to repay the loan amount.

Also Read PSPA Punjab Social Protection Authority Govements New Programs.

Youth Loan Application Form:

You can get an online application form for the Prime Minister Youth and Agriculture Loan, complete it, and submit it online. You must have your original CNIC card to submit an online application.

To get this loan, you must complete the application form with all the original data. If you provide fake data, your application will be canceled. Click on this link to access the online application form.

Procedures for Youth Loan Program:

You must submit an online application to get a Prime Minister Youth Agricultural Loan. No application can be submitted physically. You must apply to the official website of the Government of Pakistan.

To get a loan under the Prime Minister Loan Programme, you must complete an online application. You must have a PakistanCNIC card to submit this application.

- First, enter your CNIC card number and the Date of issue of CNIC to be entered.

- Afterward, you must select your Tier (T1, T2, T3) according to your loan amount.

- After that, you must select the bank under which you want to get the loan.

- Complete further details, such as bank details, which were required for the loan.

This is how to complete and submit your application online.

The applicant should register his information correctly so that he does not face any problems in getting the loan. The Youth Loan Board will verify your application with NADRA data. After that, you will be transferred your money to the respective bank.

Fees and charges of application for Loan:

The fee for submitting this application is only around Rs.100. If any bank representative asks you to pay more than Rs.100 in the morning, you can file a complaint against him.

Eligibility Criteria for PM Youth Loan Scheme 2024

- All Pakistani citizens who are ID card holders between the ages of 21 and 45 can easily avail themselves of this loan and grow their businesses.

- Applicants for this loan must be at least 18 to start IT and e-commerce-related businesses. His education must be at least matriculation or its equivalent to matriculation education.

- People from every province of Pakistan can avail of this loan amount and increase their business.

Required Documents for PM Loan Scheme

- You need only a Pakistan ID card to apply for the Prime Minister Youth and Agriculture Loan. Without an ID card, you cannot get the loan amount.

- Bank Account and details. You must also have a bank account to transfer your loan amount.

- People who want to get a loan to start an IT or e-commerce-related business. They must have this matriculation certificate and proof of their business.

Youth Loan Tenure:

- The loan tenure for Tier 1 is approximately 5 years.

- The loan tenure for Tier 3 & Tier 2 is around 8 years.

The repayment period of the loan can be shortened or extended, depending on the bank you choose. You can pay your markup amount in the first two years and the remaining (capital) in the next three years.

How is not eligible for the PM Youth Loan Program?

Under the Prime Minister’s Youth Loan Program, only those who meet the criteria will get loans.

Following people cannot benefit from the scheme

- Who has applied physically?

- Persons with fake CNIC cards.

- Pakistanis living abroad.

- Government employees are strictly prohibited from applying for loans under this scheme.

- People starting IT/E-commerce-related businesses who do not have a matriculation certificate

- Those who have taken a government loan and have not repaid it can also not apply for this scheme.

Which gender has the upper hand in the PM Youth Loan Scheme?

- In this loan scheme, all men and women will be provided loans. Equally, no one will get any preference.

- Loans will be provided to all men and women under the same arrangement; moreover, women will be given priority in about 25 percent of the loans.

Conclusion

The Prime Minister of Pakistan, Shahbaz Sharif, laid the foundation for providing agricultural and business loans for the youth of Pakistan. can do Thanks to this program, you can get loans ranging from 5 lakhs to 75 lakhs, that too at low interest rates. For this, you have to follow certain criteria, fill out a form, and attach the documents required to avail of the scheme. After that submit the form. If you are considered eligible for the PM Youth Loan Scheme, you will be informed about your eligibility through a message.

Frequently Ask Questions (FAQs)

PM Youth Loan Scheme can be availed through how many banks?

PM Youth Loan Scheme can be availed through 15 different banks in Pakistan.

How much can be borrowed through the PM Youth Loan Program?

Through PM Youth Loan Scheme, you can get loans ranging from 5 lakhs to 75 lakhs.

Are there any application charges for the Prime Minister Youth Loan Scheme?

Yes, you have to pay Rs 100 per application to apply for the Prime Minister Youth Loan Scheme.

PM Youth Loan Helpline

In this article, we have provided you with all the information about the Youth Business and Agriculture Loan provided by Prime Minister Shehbaz Sharif. If you still face any kind of trouble you can be contacted at:

Phone Number

051 9203585